There is more than one dimension to giving care. It involves much effort and reward, but finances are largely another issue altogether. The stress of cost and budget estimation can overwhelm caregivers. Simplifying the process of budgeting for caregivers by breaking down and organizing their finances can make a whole lot of difference.

After all, understanding the financial side of caring reduces not only your stress levels but also enhances your capacity to provide good care. With insight into the key financial strategies and planning tools, you will turn your financial uncertainty into a structured and confident approach.

In this article, we will share some essential financial planning tips for all caregivers. You will know how to handle the costs of caregiving effectively and plan for upcoming expenses.

Most caregivers face unique financial issues that further impact the emotional and physical well-being of caregivers. Here are a few challenges that caregivers face:

It becomes more painful as the costs can come from the most unexpected places. Medical supplies, transportation, home modifications; the list is endless. It clearly requires a solid financial planning for caregivers that will help caregivers stay prepared for both the day-to-day and the surprising expenses of caregiving.

Why Financial Planning Matters for Caregivers:

For home care workers and in-home caregivers, having a financial plan is especially important since caregiving is often a long-term responsibility. A well-structured plan will help you stay ready for both everyday expenses and the unexpected costs that may arise.

Financial planning for home care workers doesn’t mean limiting their expenses completely. It is about making decisions that let you cut down unnecessary expenses, allowing you to save more money.

For example, caring for someone with Alzheimer’s or dementia presents unique financial challenges. As the disease progresses, individuals often require specialized care, which can lead to increased costs. Every little action taken, be it saving a few bucks every week or cutting down some needless expense, adds to your healthy financial condition.

You can roll in for online dementia training at Learn2Care first step towards providing exceptional care for individuals with dementia.

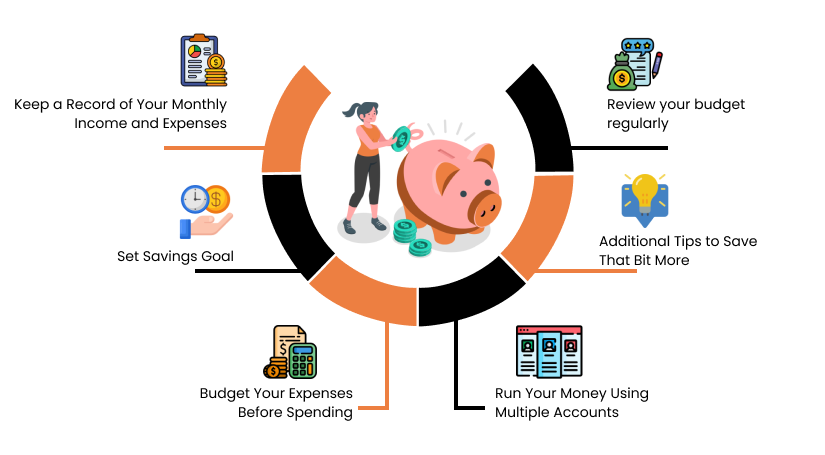

The first step to effective budgeting for caregivers is knowing where your money comes from and where it goes. This means detailed record keeping of your income and expenses every month. In doing so, you will paint a clear picture of your financial situation, which is very key to making informed decisions.

Recording Your Income

Do this right after you get your paycheck, allowance, or any other kind of income—write it down in your financial notebook or budgeting app. It should contain all sources of income, such as salary, bonus, freelancing, and the rest of them.

Knowing one’s income helps one determine how much money one is earning monthly. It also helps you work out patterns like seasonal bonuses or irregular income side jobs strategically boosting savings or payments toward debt.

Tracking Your Expenses

Next, log everything you spend your money on. This will include not only the big-ticket items, like rent, utilities, and food, but also the mundane things added over time, such as coffee, snacks, and subscription services. Knowing where all this hard-earned money goes can sometimes be pretty enlightening and usually brings out those blind spots in spending that you were least aware of.

This will keep you on track by budgeting money spent into essentials—housing, utilities, food—and non-essentials like entertainment, eating out, and shopping. You will know where to cut from so that it doesn’t affect your quality of life.

Without a goal, you will not be successful. Your savings could be for a vacation, a down payment on a house, or adding to an emergency fund. Saving toward a realistic goal will be motivating.

Define Your Long-Term Financial Goals

Think of what you’ll do in the long run with your savings. You might want to have a house of your own, save for your child’s education, or save for retirement. When you are very clear about the point you want to reach or need to achieve, then it’s a must to break it down into monthly objectives that need to be saved.

For example, if you desire to save $10,000 to make part payments on a house in five years, you will need to save about $ 167 per month. Seeing that 10,000 is way too much for one to spare and save, one would begin to have the inclination to put off saving to a later date. Breaking your goal down by what is palatable makes it easier to stick with.

“Aim high but keep your goals realistic”

It is as important as making savings goals. Overcommitment to savings only leads to frustration and burnout, especially if you are always dipping into savings to cover expenses. Honestly, know what you can afford to save and adjust the goals accordingly.

Budgeting is the very core of financial management. When it comes to budgeting for dementia care requires proactive planning and careful management of resources.

Caregivers should be prepared for rising medical costs, which may include prescription medications, therapy sessions, and doctor visits specifically for managing dementia symptoms. A well-worked-out budget allows you to channel your income towards the different expenditure categories in such a manner that all your needs are met while making some real progress on the savings goals.

Essentials: Cost of Living

Begin by budgeting for your essential expenses. This includes some non-negotiable costs that are necessary for your day-to-day living, such as food, grocery shopping, eating out, and meal planning.

Housing: Rent or mortgage, property taxes, and maintenance.

Utilities: Lights, water, gas, internet, phones.

Non-Essentials: Discretionary Spending

Then, list where some of the money on the budget will go for things that are less important. These are the items on the budget where you have more flex to shift and trade for saving. Some of the discretionary spending includes:

Transportation: Car payment, gas, parking, public transportation, or maintenance fees.

Insurance: Like health, auto, home, and life premiums.

Entertainment: Weekend movies or concerts, eating out, going on a vacation.

While inviolable expenses, these are the costs for your balanced living, and from most spheres of which you can, if necessary, save. For example, reduce eating out or replace one form of entertainment with a cheaper alternative.

Savings: Building Your Financial Future

That just means that, apart from your fundamental and discretionary spending, the balance of your income is basically your savings, or money lying with you for your future requirements. That means an emergency fund for unexpected outlays—like medical expenses or car repairs—and retirement savings. Nothing, really, but what you pay into your 401(k) or your IRA.

Financial Goals

Saving to buy a house, set up a business, or for educational goals.

Maintaining multiple accounts for different expenses is one of the best ways to manage your money. The thinking behind it is that you would keep your finances organized and easily be able to spend money according to your budget.

Opening Different Bank Accounts

Consider opening separate bank accounts for each of the key expense categories. For example, you can have one account for Essential Expenses, another for Discretionary Expenses, and a third for Savings. This makes it easy to know what money goes to what particular class and not overdo it.

Envelopes: Cash Management Methods

If you’re a cash person, the most effective way to manage your money is with the envelope system. Label your envelopes with expense categories, like food, fun, and getting around. Put your pocket money in these envelopes at the beginning of the month. When the envelope is empty, you cannot fill it up until next month, so you learn to stick to your plan.

Discipline is of Utmost Importance

The main thing to bear in mind while running separate bank accounts or the envelope system is to remain disciplined. Spend only what you have set aside in the name of each category, and do not permit yourself to spend outside of these finances unless it is fundamentally important. Staying disciplined will help ensure you avoid overspending and stay on track with the amounts you’ve allowed yourself to spend in each category.

In line with the above strategies, there are a few other tips you can implement to save even more. Most of the financial planning tips for caregivers link to common habits you will inculcate to minimize costs and increase savings.

Smart Shopping Habits

In saving while at the supermarket, some of the habits you will get to adopt will save you a lot in the long haul. Such include:

A want is something that simply fulfills or pleases your desire. One can perfectly do without it. Before you spend a dime, stop and ask:

Do I Really Need It? Consider whether the item is significant to your daily life. If not, pause and ask yourself if you still absolutely need it.

Do I Already Have Something Similar? Do you already have something that does the same function? For example, if you have a working smartphone, do you really need to buy a new model?

Do I Need It Now? Delaying an acquisition can sometimes save you time and prevent an unwise impulse to buy. If something isn’t really needed, give yourself a cooling-off period before deciding to get it.

Taking a little time to differentiate between needs and wants can help you spend well now and save you from wasting money in the future.

Your financial situation will also change gradually over time, and so you have to update your budget regularly to make subsequent changes. Events such as moving to a new job, marriage, or the arrival of a baby can greatly change your income and expenditure pattern; therefore, your budget should also change accordingly.

Budgeting for changes in income

Whenever your income expands, save and/or get out of debt using part of the increase. If your income falls, you may have to reduce some of your optional expenditures to live within your budget.

Update Financial Goals

Be as flexible as your priorities. For example, when you have a savings plan and you are achieving your goal, you can shift from one target to another or diversify the savings.

Revisiting the goals of your budget on a regular basis A good budget should never be detached from your long-term goals. You have to always visit and revisit your financial goals against your budget to ensure that they harmonize.

Although it’s necessary to have one, that doesn’t mean you must never deviate from your budget. Just as personal circumstances often change with no warning, a budget sometimes needs some flexibility to accommodate these changes in your life. It’s still about being able to adapt and to allow the plan you have for your money to remain intact.

Here are some tips that you can follow if you are an in-home caregiver taking care of your loved one.

The care of older people in their homes includes a number of expenses that family caregivers might not normally think about. Keeping in mind these costs will set up a practical budget so one can better plan for the in-house caregiver’s financial plan. Following are the key areas incurring expenses:

Budgeting for caregivers is part of financial planning for in-home caregivers. It involves much more than just keeping records of their expenses. It’s about handling whatever might possibly come up in the future. Here is how to develop an effective caregiving budget:

Identify and List All Costs: Begin by listing out all of the identified and potential costs associated with providing care. This may include but is not limited to, medical supplies, home modifications, personal care services, and transportation costs. Do your best to be thorough in listing out all financial liabilities.

Track Spending: Very close records should be kept of all caregiving-related expenses. This can be done through spreadsheets or apps that help when it comes to making a budget and financial software. Tracking will help to look at spending patterns and pinpoint problems.

Estimate future costs: When financial planning for caregivers, consider the current and future expenses. As time goes by, the needs of the care recipient are going to be higher, which may translate into higher costs, so the cost in future terms should also be estimated. This would involve changes in medical requirements or adjustments in care services.

Save: To the extent one can afford, set some money aside strictly for caregiving. This will provide a cure for unexpected costs and keep a family’s finances on an even keel.

Review and Revise as Needed: Periodically review your budget to ensure it is accurate and current and reflects your changing expenses or care needs. Update your budget if you incur new costs or experience changes in income or other financial circumstances.

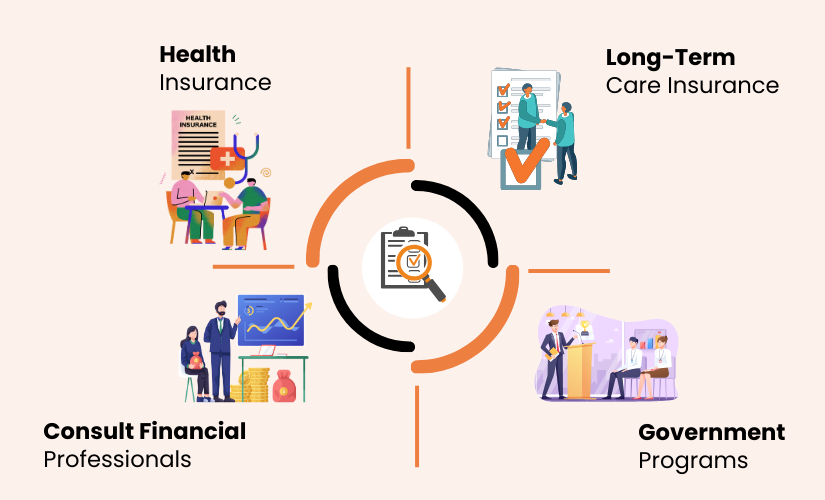

Your health insurance can have significant financial consequences related to caregiving. Knowledge of your loved one’s health insurance policy will enable you to better comprehend and control the cost associated with treatments. Consider these items:

Long-term care insurance is designed to cover services generally not covered by regular health insurance. Important to note:

There are different government programs with cash support for care for seniors:

Medicare: Medicare provides limited coverage for in-home health care in the form of part-time skilled nursing care services and some necessary medical supplies, but it does not generally provide coverage for personal care services.

Medicaid provides more comprehensive coverage of home care services for eligible persons that may include personal care, and even home modifications, in some states. Although great flexibility is provided to the states in the design of their respective programs, specifics, as they relate to your own state or local program regarding eligibility and benefits, will be very worthwhile.

Veterans Benefits: Additional veterans’ benefits can be available through the Veterans Benefits Administration.

As previously discussed, insurance and government benefits are very complicated to manage. The participation of a financial professional can be of great aid to a parent. A professional will assist with:

| Checklist Item | Details |

|---|---|

| Track Monthly Income and Expenses | Document all sources of income and expenses. Categorize spending to understand where money is going and identify areas for cuts. |

| Identify Caregiving-Related Expenses | Include medical, transportation, home modifications, and personal care products. Track these separately for easy budgeting. |

| Build an Emergency Fund Specifically for Caregiving | Set aside 3-6 months of caregiving-related expenses for unexpected emergencies like medical needs or sudden travel. |

| Check Eligibility for Government Aid and Insurance | Research Medicare/Medicaid, veterans’ benefits, family leave options, and private insurance policies for potential financial assistance. |

| Set Financial Goals and Strategies for Saving | Develop savings plans for long-term care costs, medical expenses, and retirement. Break down larger goals into smaller, actionable steps. |

| Track Tax-Deductible Caregiving Expenses | Research and track tax deductions such as caregiver-related medical expenses, mileage, and supplies that can reduce taxable income. |

| Evaluate Long-Term Care Insurance | Consider investing in long-term care insurance or evaluate existing policies to ensure adequate coverage for future caregiving needs. |

| Create a Will and Power of Attorney | Make sure legal documents are in place to manage finances, healthcare decisions, and property in case of emergency or incapacity. |

| Review Retirement Savings and Plans | Assess how caregiving responsibilities might impact retirement savings, and plan accordingly to avoid depleting long-term financial resources. |

| Create a Caregiving Budgeting System | Establish a clear budget, including caregiving costs, household expenses, and personal finances to avoid overextending and stay financially stable. |

| Consider Hiring Financial Assistance or Planner | Explore the possibility of consulting with a financial advisor who specializes in caregiving-related finances to ensure a solid plan and ongoing guidance. |

| Review and Update Financial Plan Regularly | Regularly revisit your financial planning as caregiving needs evolve and adjust accordingly to ensure continued financial stability. |

It’s clear that budgeting for caregivers requires a good balance of financial foresight, strategic planning, and knowledge of the resources. With a full grasp of in-home senior care costs, you are on the road to establishing an all-inclusive budget that can make insurance and government benefits significantly reduce the burden of this financial requirement.

As a professional caregiver, you should enhance your knowledge with the inclusion of at least some elements of financial literacy. Enrich yourself with a comprehensive caregiver training course containing professional training on financial planning for caregivers.

At Learn2Care, we offer a comprehensive caregiver training program designed to equip you with the skills, knowledge, and financial planning tools you need to succeed in your caregiving role. With the right training, you’ll be well-prepared to manage both the emotional and financial demands of caregiving, ensuring a more secure future for both you and the loved ones you care for.

Contact us to inquire about our state-wise training courses and take the first step towards upskilling your team with a 14-day free trial!